What You Need to Know About Colorado Tax Refunds

Hey there! Let's talk about Colorado tax refunds and how they work. If you’ve received a refund from Colorado for the previous year, it’s important to understand how it might affect your federal taxes. In simple terms, the refund you got last year is essentially money you overpaid in state taxes. Now, depending on whether you itemized deductions or took the standard deduction, this refund could have an impact on your federal return this year. So, let’s break it down step by step.

Breaking Down the Postcard Format Form

The form you’ll encounter is often in a postcard-like format, but don’t let its simplicity fool you—it packs some important information. On this form, you’ll see details like the amount of your Colorado income tax refund from the prior year. For instance, if you're looking at your 2024 taxes, the form will ask if you received a state or local tax refund in the previous year. This is where clarity comes in handy because it helps you avoid potential pitfalls when filing your federal return.

Itemizing vs. Standard Deduction

Now, here's the deal: If you took the standard deduction last year instead of itemizing, this additional information might not apply to you. That’s right—no need to stress over it. However, if you did itemize, it’s crucial to report the refund correctly. The good news is that most tax software programs will guide you through this process, so you don’t have to figure it all out alone.

Read also:Kristi Noem Bikini Moments Fashion Politics And Public Perception

Colorado Department of Labor & Employment

Let’s talk about the Colorado Department of Labor & Employment (CDLE). They play a big role in managing unemployment benefits and taxes. If you received unemployment benefits during the previous year, this form will show the total amount you were paid and any income tax withheld, assuming you opted for withholding. Pro tip: For more details, check out the CDLE website. It’s packed with useful resources to help you navigate this process.

Handling Colorado’s 1099G Forms

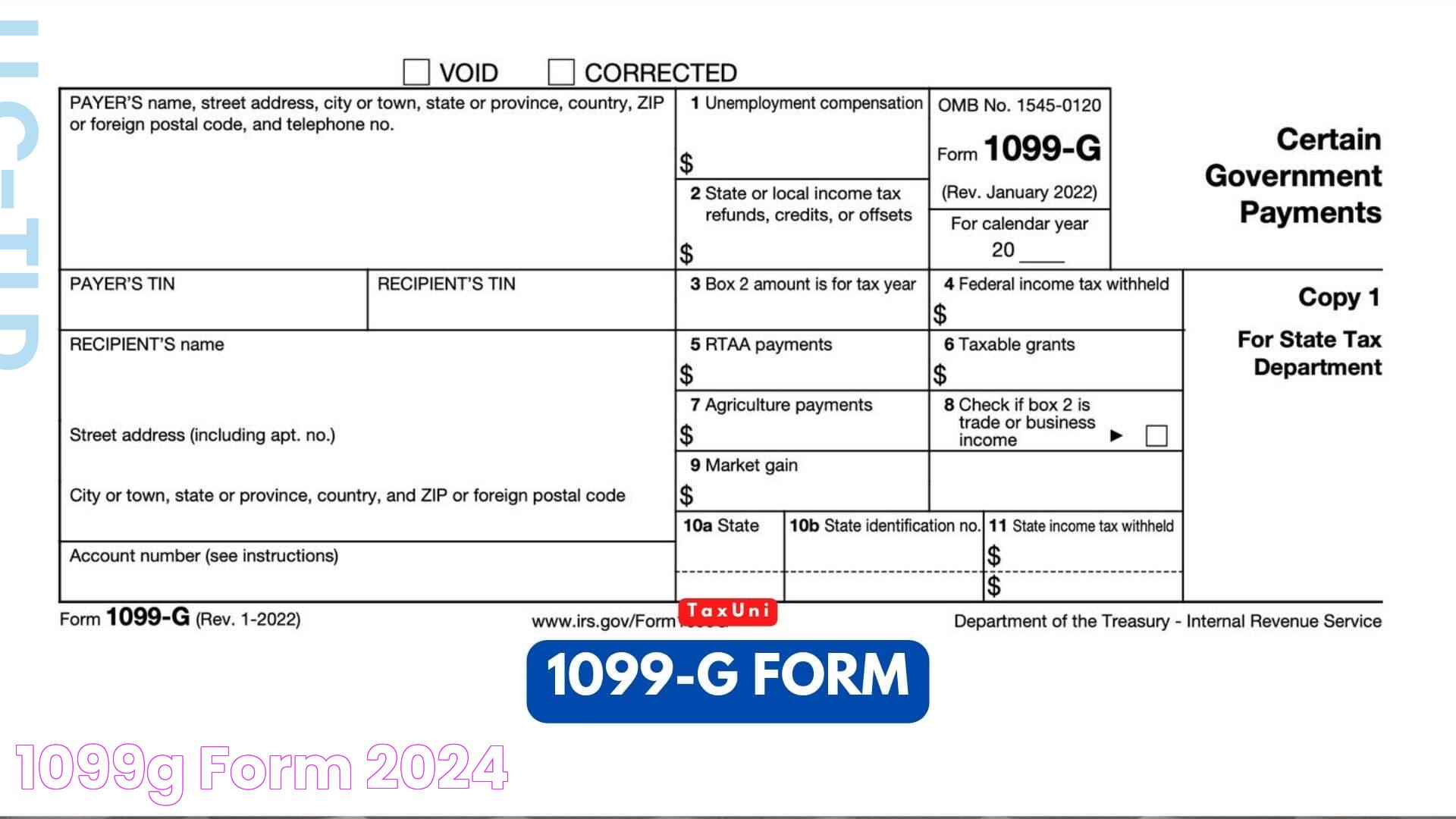

What’s on the 1099G?

So, what exactly is a 1099G? Well, it’s a form that reports certain payments you received, such as unemployment compensation or state tax refunds. If you’re trying to find the Employer Identification Number (EIN) and address for your 1099G, don’t panic. You can usually access this information online through the state’s portal where you manage your benefits. Just ensure you have the correct city and ZIP code, as these can sometimes change.

Why the IRS Cares About the 1099G

The IRS requires 1099G forms under Section 6050E of the Internal Revenue Code. This ensures transparency and compliance with federal tax laws. Even if you think the refund isn’t taxable—say, because you didn’t itemize last year—you still need to provide the EIN and address. Otherwise, your tax software might throw errors, and nobody wants that hassle.

Steps for Filing Colorado Taxes

Important Information for Your Colorado 1099G

When it comes to filing your Colorado state taxes, the 1099G form is your best friend. It contains all the necessary information you need to report your income accurately. The Colorado Department of Revenue requires all 1099 forms to be filed, so make sure you have everything in order. Often, clients forget to bring their 1099Gs for state refunds, which can slow down the process. To avoid delays, gather all the EINs and addresses that appear on these forms.

How to Manage Your Tax Account

Managing your tax account has never been easier thanks to tools like Revenue Online. This platform allows you to file your individual income tax return, submit documentation electronically, or even apply for a Property Tax Credit (PTC) rebate. Each type of tax has specific requirements regarding how you pay your tax liability, so it’s worth learning more about each one. Whether you’re dealing with sales tax, use tax, or income tax, understanding the payment methods will save you time and headaches.

Final Thoughts

At the end of the day, taxes can feel overwhelming, but breaking things down into manageable steps makes it much easier. Whether you’re dealing with a Colorado income tax refund, unemployment benefits, or 1099G forms, staying organized is key. If you ever find yourself stuck, don’t hesitate to reach out for help. And remember, the IRS and state agencies are there to ensure transparency and compliance, not to trip you up. Thanks for reading, and good luck with your taxes!

Read also:Lucas Cruikshank The Teen Who Conquered Youtube