Submitting Your Individual Income Tax Return Electronically

Hey there, taxpayer! Let’s talk about something we all have to deal with: filing your individual income tax return. Whether you’re submitting your documentation electronically or applying for a PTC rebate, it’s important to know that the IRS has specific rules for how you pay your tax liability. In this guide, I’m going to break it down for you step by step so you can feel more confident when handling your taxes. This isn’t just about compliance—it’s about making sure you’re getting the most out of your financial situation.

Understanding Different Tax Types and How to Pay Them

Now, here’s the deal: each type of tax comes with its own set of rules and regulations. For instance, under Section 6050E of the Internal Revenue Code, the IRS requires transparency and compliance with federal tax laws. That means if you’re looking to pay your taxes, you’ll need to know exactly what type of tax you’re dealing with and how to pay it correctly. Let me walk you through some examples. If you’re filing for Colorado income tax, you’ll want to make sure you’re aware of the state’s specific requirements. Plus, it’s always smart to double-check whether you’re itemizing or taking the standard deduction, as that can affect how you proceed.

Managing Your Tax Account with Revenue Online

Managing your tax account doesn’t have to be a headache. Revenue Online is a powerful tool that can help you stay on top of everything from payments to refunds. If you haven’t already, take some time to set up your account and get familiar with the platform. It’s designed to simplify the process for you, and trust me, simplicity is key when it comes to taxes. You can track your payments, view your refund status, and even make sure your information is up-to-date. It’s like having a personal assistant for your taxes—only better because it’s free!

Read also:Unpacking The Camilla Araujo Onlyfans Leak A Closer Look At Privacy And Fame

Why Transparency Matters in Tax Filing

Let’s talk about why transparency is such a big deal. The IRS requires certain forms, like the 1099G, to ensure that everyone is on the same page when it comes to reporting income and refunds. If you’ve received a Colorado income tax refund in the previous year, it’s crucial to include that information on your federal return. And if you’re wondering whether your refund is taxable, here’s the scoop: it depends. If you itemized deductions last year, it might be taxable. But don’t worry—if you’re using tax software, it’ll guide you through the process and flag any potential issues.

Common Questions About Tax Forms and EINs

Let’s address some common questions people have about tax forms and Employer Identification Numbers (EINs). For example, someone might ask, “Can someone provide me with the EIN and address for the State of Colorado?” The answer is yes, but you’ll need to know where to look. The Colorado Department of Labor & Employment (CDLE) is a great resource for this kind of information. And if you’re looking for the EIN and address for a 1099G form, you can usually find it on the form itself or by visiting the CDLE website. It’s all about knowing where to look and who to ask.

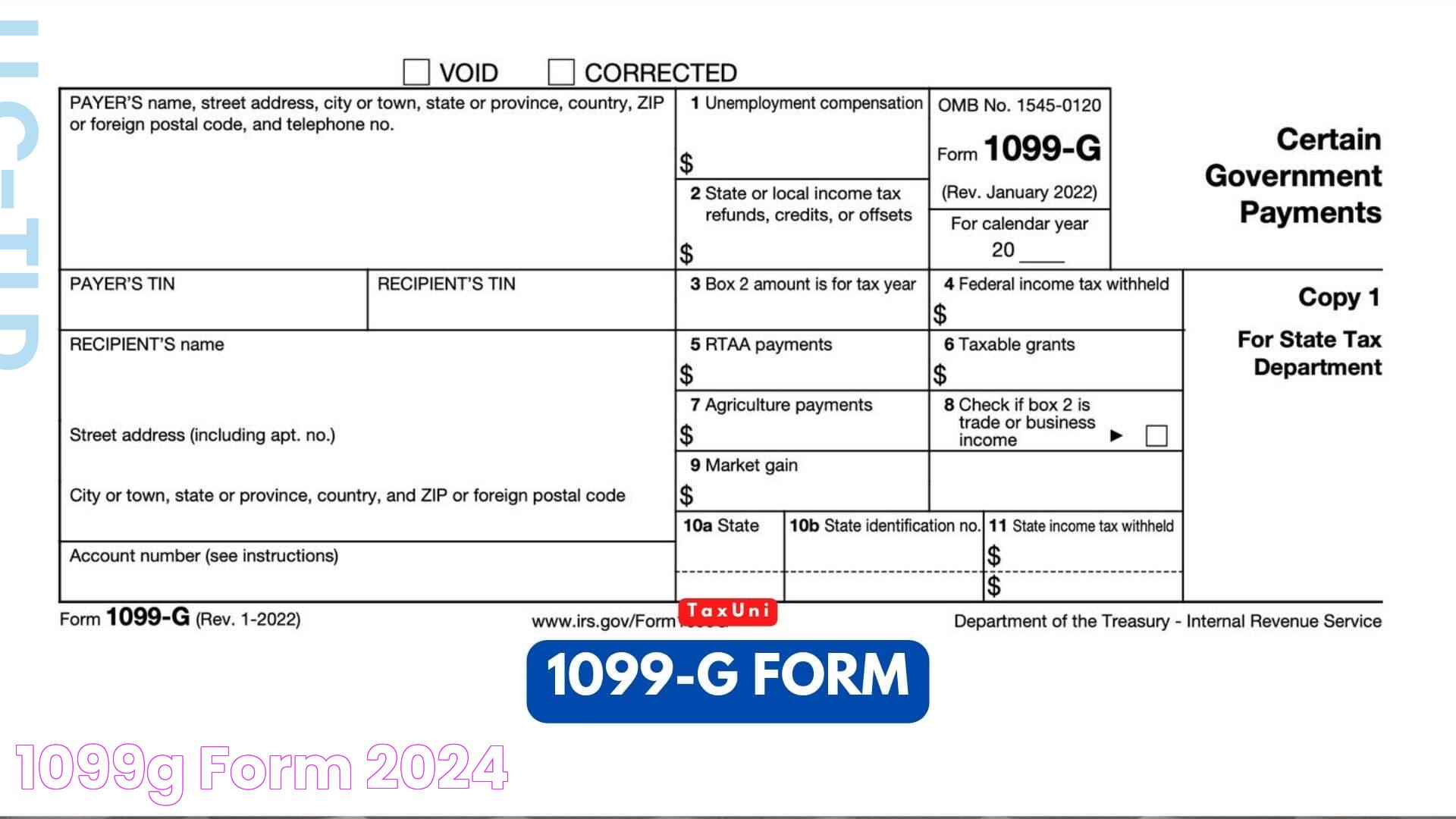

What’s on the 1099G Form?

The 1099G form is a postcard-sized document that reports certain payments made to you during the tax year. This includes things like unemployment compensation, state or local tax refunds, and other government payments. Specifically, it will show the amount of benefits you received during the previous year and the amount of income tax withheld, if you opted for that. For example, if you got a Colorado income tax refund last year, that amount will be listed on the form. It’s a handy little document that can make a big difference when it comes to filing your taxes accurately.

Colorado State 1099 Tax Filing Requirements

When it comes to Colorado state tax filing, there are a few things you need to know. First, all 1099 forms must be filed with the Colorado Department of Revenue. This ensures that the state has all the necessary information to process your taxes correctly. If you’re unsure about where to find the EIN and address for your 1099G form, don’t worry—most of the time, you can access this information online through the CDLE website. And if you’re managing your benefits through an online account, chances are you’ll have access to your tax forms there as well.

Wrapping It Up

Taxes can seem overwhelming, but with the right tools and a little bit of knowledge, you can navigate the process with ease. Whether you’re filing your individual income tax return, managing your tax account, or figuring out the details of a 1099G form, remember that you’re not alone. There are resources available to help you every step of the way. So take a deep breath, gather your documents, and let’s get this done together. You’ve got this!