What Are Assumable Mortgages, and Why Should You Care?

Let's break it down in plain English. An assumable mortgage is essentially a home loan that you can "take over" from the current homeowner. Instead of going through the hassle of applying for a brand-new mortgage, you step into the seller's shoes and continue paying their existing loan. This includes the same interest rate, terms, and remaining balance. It's like inheriting a great deal on a house without having to negotiate mortgage rates all over again.

Why Would Anyone Want to Assume a Mortgage?

Here's the kicker: assuming a mortgage can save you serious money. Imagine walking into a deal where the seller's mortgage has an interest rate far lower than what you'd get if you applied for a new loan today. That's not just a win—it's a jackpot. Plus, the application process is often simpler because the loan already exists. However, there’s a catch: not all mortgages are created equal when it comes to assumption. Let's dive deeper.

Which Types of Loans Can Be Assumed?

Not every loan is eligible for assumption, so let's separate fact from fiction. FHA, VA, and USDA loans are the big three when it comes to assumable mortgages. These government-backed loans often allow buyers to step into the seller's shoes under specific conditions. Conventional loans, on the other hand, rarely offer this option unless the mortgage agreement explicitly permits it. Always double-check with the lender to ensure the loan is assumable before getting your hopes up.

Read also:Remembering Robert Urich A Life Cut Short By Synovial Sarcoma

How Do You Know If a Loan Is Assumable?

The first step is simple: pick up the phone and call the lender. Ask them point-blank if the mortgage is assumable. If the answer is yes, congratulations—you're one step closer to scoring a sweet deal. Next, you'll need to complete an application, which will include details like your income, assets, and credit history. Think of it as a mini-version of the traditional mortgage application process, but with fewer hurdles.

Important Note: Not Everyone Qualifies

Just because a mortgage is assumable doesn't mean you'll automatically qualify. Lenders still need to make sure you're a responsible borrower. For example, FHA loans typically require a minimum credit score of 620 (or 580 in some cases). Similarly, VA and USDA loans have their own set of criteria. Bottom line? Do your homework and make sure you meet the requirements before pursuing this route.

Saving Money with Assumable Mortgages

One of the biggest advantages of assuming a mortgage is the potential savings. If the seller's loan has a lower interest rate than what's currently available, you could save hundreds—or even thousands—over the life of the loan. Plus, you won't have to pay costly closing fees associated with a new mortgage. However, keep in mind that some assumable loans come with additional fees or requirements, so read the fine print carefully.

What About Refinancing vs. Assuming?

Refinancing and assuming a mortgage are two different animals. When you refinance, you're replacing your existing loan with a new one, often at a better interest rate. But refinancing isn't always the best choice, especially if your current loan has excellent terms. On the other hand, assuming a mortgage allows you to keep the original loan intact while transferring ownership to you. It's like keeping the good stuff and passing the baton.

Example: A Real-Life Scenario

Picture this: you're buying a home from someone with a 30-year fixed-rate mortgage at 3.5%. Current market rates are hovering around 6%. By assuming their mortgage, you'd lock in that lower rate and enjoy smaller monthly payments. Sounds pretty appealing, right? Just remember that the loan's remaining term will apply to you, so factor in how long you plan to stay in the home before jumping in.

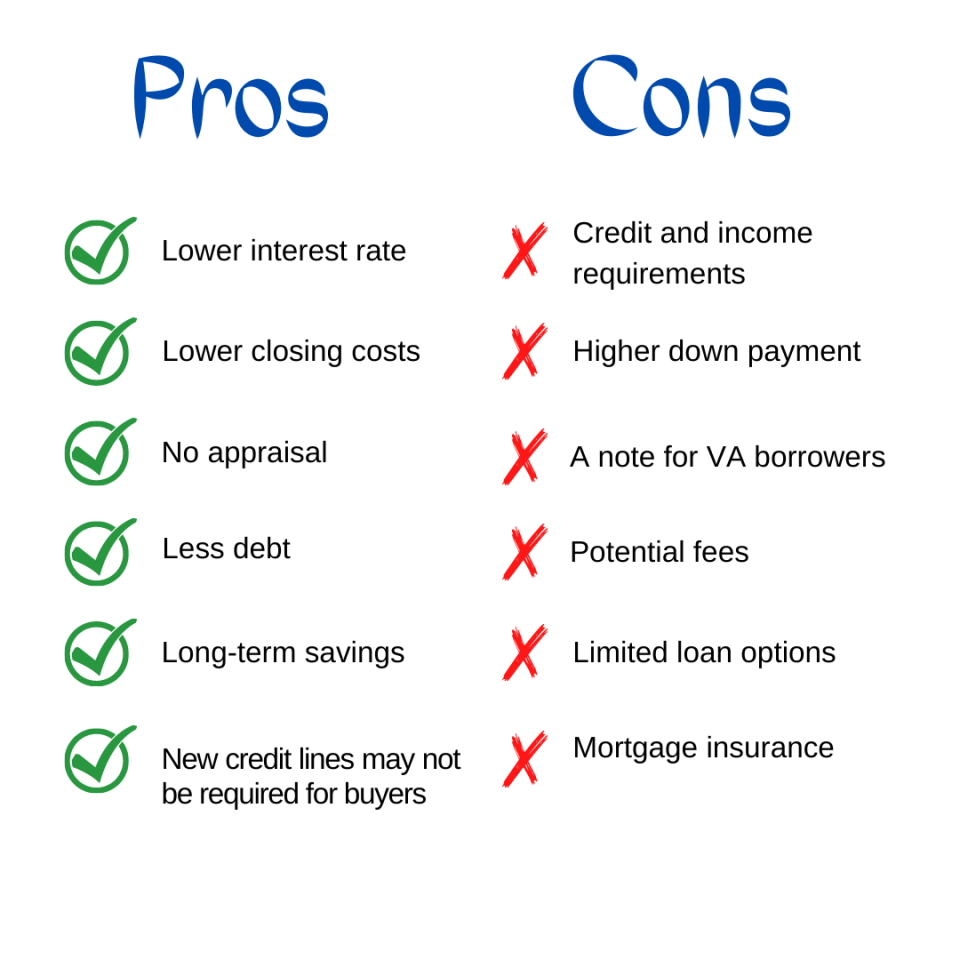

Assumable Mortgages: Pros and Cons

Like any financial decision, assuming a mortgage has its pros and cons. On the plus side, you could save money on interest rates, avoid closing costs, and simplify the buying process. But there are downsides too. For instance, you'll be stuck with the seller's loan terms, which might not align perfectly with your needs. Additionally, some assumable loans come with extra fees or restrictions, so always read the fine print.

Read also:Discover The Captivating World Of Diva Flawless Nude Content

Final Thoughts: Is an Assumable Mortgage Right for You?

At the end of the day, assuming a mortgage can be a fantastic option for the right buyer. If you're buying a home from someone with an FHA, VA, or USDA loan, it's definitely worth exploring. But don't rush into anything without doing your due diligence. Talk to the lender, review the loan terms, and make sure you meet the qualifications. And hey, if you're feeling overwhelmed, don't hesitate to reach out to a trusted mortgage professional for guidance.

Chase offers a variety of affordable lending options, including FHA and VA loans, to help make homeownership more accessible. Use our affordability calculator to estimate your budget, and explore homebuyer grants in your area to stretch your dollar further. Visit our mortgage education center for tips and resources to guide you through every step of the homebuying journey. From applying for a loan to managing your mortgage, Chase MyHome has you covered every step of the way.

Insurance products are available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency operating as Chase Insurance Agency Services, Inc. Certain services, such as custody, are provided by JPMorgan Chase Bank, N.A. While we'd love to provide more details, some sites restrict us from doing so. For the full scoop, check out our resources and speak with a specialist.