What Sets FHA Loans Apart from Conventional Loans?

So, you're thinking about buying a home, huh? Let me break it down for you. One of the biggest differences between an FHA loan and a conventional home loan is the down payment requirement. With an FHA loan, you can put as little as 3.5% down, which is a huge relief for many first-time homebuyers. Plus, the credit qualifying criteria are more lenient, meaning even if you don't have a perfect credit score or a long credit history, you still have a shot at securing a mortgage. It's like having a second chance to prove yourself as a responsible borrower.

Why Choose an FHA Loan?

Here's the deal: FHA loans are designed to help people who might not qualify for a conventional loan. If you're someone who doesn't have a credit history or has had some minor credit issues in the past, FHA loans can be a game-changer. They offer flexible guidelines that make it easier for a wider range of people to buy a home. It's all about opening up opportunities for everyone, not just those with perfect credit scores.

Savings and Costs with Refinancing

Now, let's talk about refinancing. The amount you save on a refinanced mortgage can vary depending on the loan you choose. But here's something important to keep in mind: if you refinance with a longer term than what's left on your current loan, you'll end up paying more in interest over time. It's like trading short-term savings for long-term costs. So, before you decide to refinance, make sure you weigh the pros and cons carefully.

Read also:Aishah Sofey Leaks Understanding The Impact And Mystery Behind The Controversy

Credit and Property Approval

Almost all home lending products, except for the Interest Rate Reduction Refinance Loan (IRRRL), require credit and property approval. This means that lenders need to ensure you're financially stable and that the property you're buying is worth the investment. It's their way of making sure both you and they are protected in the long run.

Exploring Federal Housing Administration (FHA) Loans

FHA loans are a great option for many homebuyers. They offer lower down payments and more flexible lending requirements, making it easier for people to achieve their dream of owning a home. If you're curious about how FHA loans work and whether you qualify, speaking with a Chase Home Lending Advisor can provide you with more specific information. They're like your personal guide through the mortgage process.

By the way, if you're communicating with them via text or messaging apps, remember that message and data rates may apply from your service provider. Always good to keep that in mind!

Chase Homebuyer Grant: Extra Savings for Your Dream Home

Here's a little bonus for you: the Chase Homebuyer Grant. This grant is available exclusively for primary residence purchases. Depending on the specific loan product you choose—like the Dreamaker™, Standard Agency, FHA, or VA loan—you could be eligible for either $2,500 or $5,000 in savings. But there's a catch: you must meet the applicable census tract requirements. Think of it as a little extra help to make your dream home more affordable.

Conventional Loans: What You Need to Know

Conventional loans, unlike FHA loans, aren't insured or guaranteed by government agencies. They rely on private lenders to assess your creditworthiness. While they might require a higher down payment and stricter credit standards, they often come with competitive interest rates and more flexibility in terms of loan amounts.

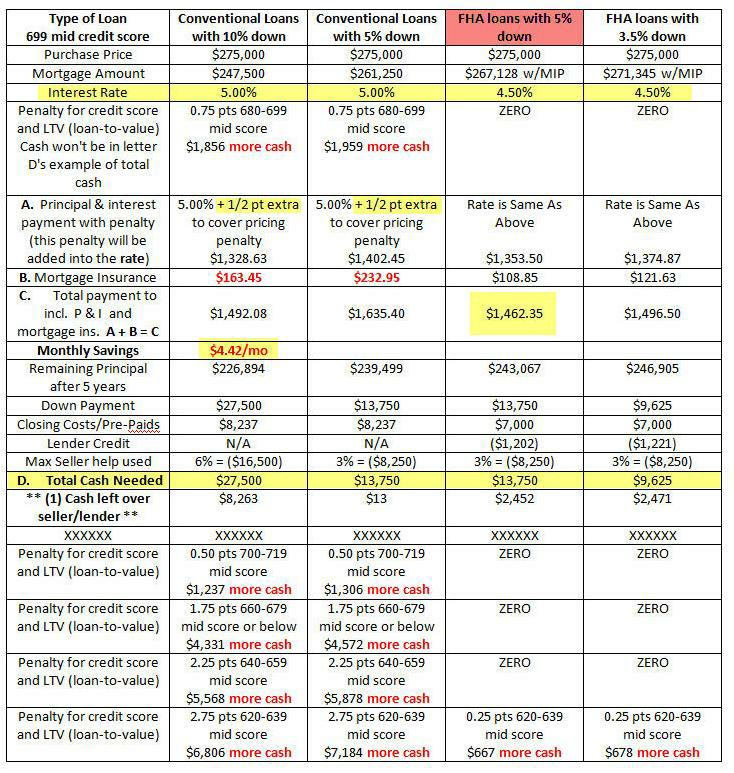

Key Differences Between FHA and Conventional Loans

Let's dive deeper into the differences. FHA loans are known for their low down payments and flexible guidelines, which can be a lifesaver for first-time buyers or those with less-than-perfect credit. On the other hand, conventional loans might offer better rates and terms if you have a strong credit profile. It's all about finding the right fit for your financial situation.

Read also:Honeytoon Teach Me First Free Your Gateway To Learning Korean

Requirements & Rates: Finding the Right FHA Mortgage

At Chase.com, you can explore the requirements and rates for FHA mortgages that suit your needs. Whether you're looking to buy your first home or refinance your current one, there's likely an FHA loan option that can help you achieve your goals. It's all about finding the right balance between affordability and stability.

Why FHA Loans Could Be Your Ticket to Homeownership

An FHA loan could make it easier to realize your dream of homeownership. They're designed to help people who might not qualify for conventional loans due to lower credit scores or smaller down payments. It's like having a safety net that gives you a chance to own a home even if you don't meet all the traditional requirements.

Understanding FHA Loans: How They Work and How to Get One

Want to know more about FHA loans? Our article breaks it down step by step, explaining what FHA loans are, how they work, and how you can qualify. It's like having a roadmap to guide you through the process. Plus, we offer helpful tips and information to make your journey to homeownership smoother.

Affordable Lending Options for Everyone

At Chase, we believe that homeownership should be accessible to everyone. That's why we offer a variety of affordable lending options, including FHA loans and VA loans. These programs help make homeownership possible for a wide range of people, from first-time buyers to veterans. We also provide tools like our affordability calculator and information on homebuyer grants in your area to help you plan your financial future.

Chase's Commitment to Homebuyers

Chase has increased its Homebuyer Grant from $5,000 to $7,500 in 15 markets across the U.S. This means you could potentially save even more money when purchasing your dream home. The grant funds can be used to lower your interest rate and/or reduce closing costs and down payment, giving you more flexibility in your budget.

Chase's Home Buyer Programs: Making Homeownership Easier

Chase offers several appealing home buyer programs, including loans with as little as 3% down payment requirements, homebuyer assistance grants, and even a payout for delayed closings. These programs are designed to make the home buying process less stressful and more affordable for everyone.

Financing Your Car with Chase

Thinking about financing a car? If you're purchasing from a dealer in the Chase network, you can apply for financing through JPMorgan Chase Bank, N.A. The dealer will be the original creditor and assign the financing to Chase. Just remember, all applications are subject to credit approval by Chase.

Final Thoughts: Your Path to Homeownership

From applying for a loan to managing your mortgage, Chase MyHome has you covered every step of the way. We're here to help you navigate the sometimes confusing world of home buying and make it as smooth and stress-free as possible. So, whether you're a first-time homebuyer or looking to refinance, we've got your back. Let's make your dream of homeownership a reality together!