Understanding Colorado's Department of Labor & Employment

Hey there! Let’s talk about the Colorado Department of Labor & Employment. This department plays a crucial role in managing employment-related matters within the state. Whether you're an employer or an employee, chances are you’ll interact with them at some point. From unemployment benefits to workers' compensation, they've got it all covered. If you've claimed itemized deductions on your federal return in the same year you received a state or local refund, that refund might be taxable income. Stay sharp, because it’s important to keep track of these details to avoid surprises come tax season.

What Happens If You’re a Victim of Identity Theft?

Let’s address something serious: identity theft. If you suspect someone has stolen your identity or you've received an overpayment of benefits, don’t panic. The Colorado Department of Labor & Employment has resources to help you navigate this tough situation. You’ll need to act quickly by filing a report and following their guidance to secure your account. They’ll walk you through the steps, ensuring your personal information is protected and your benefits are corrected.

Filing Your Individual Income Tax Return

Now, let’s dive into filing your individual income tax return. Colorado makes it simple to file your taxes and even allows you to submit documentation electronically. For those eligible, you can also apply for a Property Tax Credit (PTC) rebate. Gone are the days of waiting in long lines or mailing in paperwork. With Colorado’s online systems, you can manage everything from the comfort of your home. Just ensure you have all necessary documents ready before you start the process.

Read also:Sophie Rains Spiderman Sensation Everything You Need To Know

How Tax Types Work in Colorado

Each type of tax in Colorado comes with its own set of rules and requirements. For example, when it comes to paying your tax liability, there are specific methods and deadlines you must follow. Whether it’s sales tax, income tax, or property tax, understanding these nuances is key to staying compliant. Don’t worry, though—Colorado provides plenty of resources to help you learn more about each tax type and how to pay them correctly.

Managing Your Tax Account Online

Managing your tax account has never been easier thanks to Revenue Online. This user-friendly platform allows you to view your tax history, make payments, and update your information all in one place. It’s like having a personal assistant for your taxes. Plus, you can access your account anytime, so you’re always in control of your financial obligations. If you haven’t signed up yet, now’s the time!

Do You Need the EIN and Address for Colorado?

Yes, sometimes you’ll need the Employer Identification Number (EIN) and address for the State of Colorado, especially when dealing with forms like the 1099G. If you’re unsure where to find this information, don’t stress. The Colorado Department of Revenue provides all the details you need. Just remember, if the client didn’t itemize last year, it’s unlikely the refund will be taxable. However, most programs will still prompt you to enter this information to avoid errors, so keep it handy.

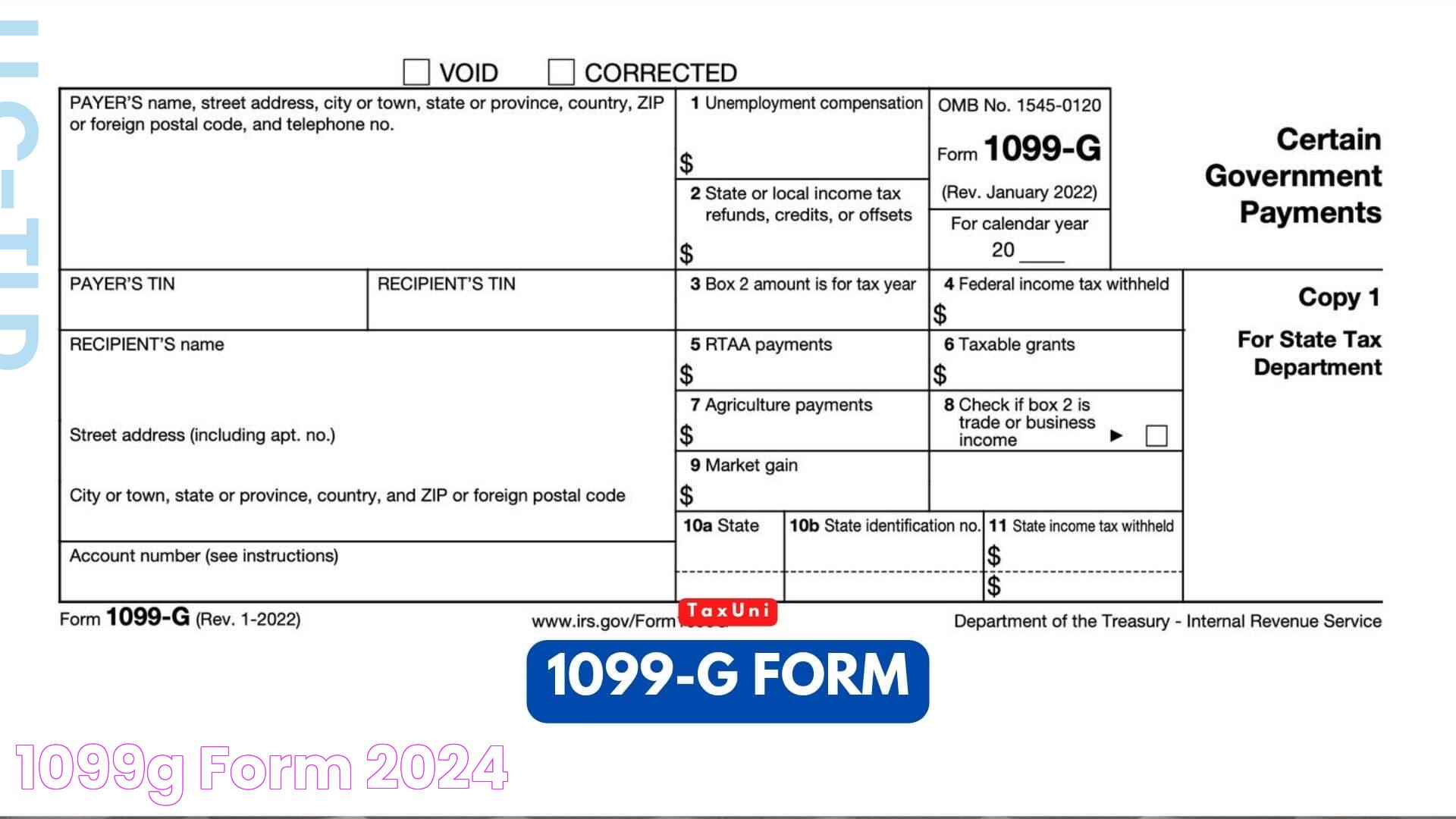

Understanding Form 1099G

Form 1099G is a vital document that shows the amount of benefits you received during the previous year and any income tax withheld, if applicable. In Colorado, along with the standard federal Form 1099, you’re required to file an additional form called DR 1106 (Annual Transmittal of State 1099 Forms). This ensures all your bases are covered and everything is reported accurately. If you’re wondering whether you can e-file your 1099 forms with Colorado, the answer is yes! It’s a convenient way to streamline the process.

Common Challenges with 1099G Forms

One common issue many people face is not having the necessary 1099G forms for state refunds. This often happens when clients forget to bring them in, leaving tax professionals stuck waiting for the EINs and addresses. To avoid delays, it’s essential to gather all the required information upfront. Here’s a quick list of what you’ll need for each state’s 1099G:

- Recipient’s name and address

- Amount of benefits paid

- Tax withheld (if applicable)

For example, if you’re filing for Colorado, make sure to leave both the state and locality fields blank unless instructed otherwise. Additionally, double-check that all the details you entered earlier haven’t been erased. Technology glitches happen, but staying organized helps prevent headaches.

Read also:Embark On The Journey Of A Lifetime With Travelvidsxyz

Looking Ahead: Updates for 2025

Active claimants in Colorado will soon have a new option starting January 2, 2025. This update aims to simplify the claims process and provide more transparency. Keep an eye out for announcements from the Colorado Department of Labor & Employment to stay informed. And don’t forget—there are no fees for opening a withholding account, so take advantage of this opportunity if it applies to you.

Final Thoughts

Thank you for taking the time to read through this guide. Whether you’re a seasoned pro or new to the world of taxes, Colorado offers plenty of resources to help you succeed. If you ever find yourself stuck, reach out to their support team. They’re here to assist you every step of the way. Remember, tax season doesn’t have to be stressful. With the right tools and knowledge, you can tackle it head-on.