Managing Your Mortgage and Home Equity

Hey there, homeowner! If you're looking for an easy way to handle your mortgage or home equity account, Chase Mortgage Services has got your back. Whether it's making a payment, checking on your escrow details, filing an insurance claim, or even requesting a payoff quote, everything is just a click away. Sign into your account and take control of your finances. It’s simple, straightforward, and designed to make your life easier. Who doesn’t love that?

Chase MyHome: Your Digital Homeownership Companion

Let me introduce you to Chase MyHome—a digital platform built specifically for homeowners like you. From hunting down the perfect property to refinancing your mortgage, Chase MyHome covers every stage of homeownership. Once you log in with your Chase account, you’ll gain access to home insights, rate comparisons, property searches, and refinancing options. It’s like having a personal assistant for your home-related needs. Pretty cool, right?

Convenient Mortgage Payment Options

Life gets busy, and we get it. That’s why Chase offers flexible mortgage payment methods tailored to fit your lifestyle. Whether you prefer mailing a check, stopping by a local Chase branch, or setting up automatic payments online, the choice is yours. Just remember to plan ahead—if you’re mailing a payment, send it 5 to 7 business days before the due date to avoid any late fees. Staying organized keeps everything running smoothly.

Read also:Exploring The Digital Age And Celebrity Privacy

Affordability Tactics and Loan Considerations

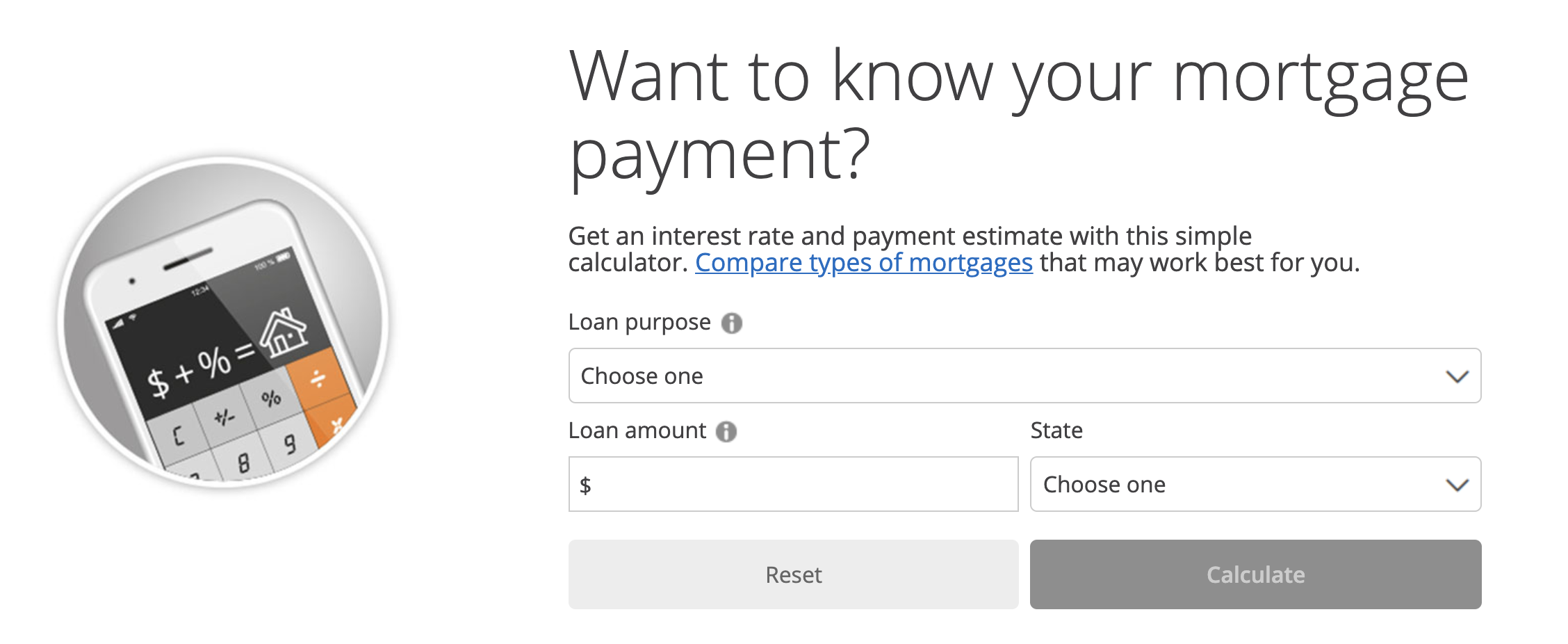

When it comes to mortgages, affordability is key. Two popular strategies to keep things manageable are the 28% rule and the 35%/45% model. The 28% rule suggests that your mortgage payment shouldn’t exceed 28% of your monthly gross income. Meanwhile, the 35%/45% model looks at your overall debt-to-income ratio. These guidelines help ensure that your payments remain sustainable over time. Of course, your actual rate, payment, and costs could vary, so it’s always smart to get an official loan estimate before committing to anything.

Annual Percentage Rate (APR): What It Means for You

Here’s another important term to know: APR, or Annual Percentage Rate. Simply put, the APR represents the total cost of credit over the term of your loan, expressed as an annual rate. For FHA loans, the APR takes into account the interest rate, any points, and mortgage insurance. Understanding the APR gives you a clearer picture of what you’re paying, helping you make informed decisions about your loan.

Additional Resources and Support

At Chase, we believe in empowering our customers with knowledge. That’s why we’ve put together a comprehensive FAQ hub where you can find answers to common questions about mortgages, escrow accounts, refinancing, and more. If you ever need clarification or guidance, don’t hesitate to reach out. We’re here to help you every step of the way.

Making Payments Made Easy

So, how exactly do you make a mortgage payment with Chase? It’s super simple. Just sign in to Chase Online and head to the “Pay & Transfer” section in the navigation menu. From there, select your payee, enter the amount, choose the “Pay From” account, set the “Send On” date, and confirm your details. Voila! Your payment is on its way. And if you’re using an older browser version, consider upgrading to ensure a secure and seamless experience.

Chase Home Lending: Your Path to Homeownership

Thinking about buying a home or refinancing your current one? Chase Home Lending offers a variety of mortgage options to suit your needs. Whether you’re a first-time buyer or a seasoned homeowner, our team of lending advisors is ready to assist you. Schedule a consultation, explore prequalification options, and discover the best loan product for you. With competitive APRs and excellent customer service, Chase is your partner in achieving your homeownership dreams.

Choosing the Right Checking Account

While we’re on the topic of financial tools, let’s talk about checking accounts. At Chase, we offer several options to fit different lifestyles and budgets. For instance, the Chase Total Checking® offer provides great benefits for new customers. Plus, with features like debit card purchases, mobile banking, and access to over 15,000 ATMs and 4,700 branches, managing your money has never been easier.

Read also:Exploring The Mckinley Richardson Controversy A Closer Look

Frequently Asked Questions

Still have questions? No problem. Here are some answers to commonly asked queries:

Why Isn’t My Mortgage Insurance Listed?

Good question! If you pay mortgage insurance premiums monthly but don’t see them listed in Box 5 (Mortgage Insurance Premiums) on your Form 1098, it’s because this box applies only to loans closed after December 31, 2006. If your loan predates that, the information won’t appear there. But don’t worry—your monthly payments are still accounted for elsewhere.

What About Business Services?

Chase isn’t just for individuals; we also serve businesses with a wide array of services. From credit cards and commercial banking to auto loans, investing, and retirement planning, we’ve got solutions for every need. And if you’re a small business owner, check out our checking and business banking options designed to streamline your operations.

Customer Service You Deserve

At Chase, we’re committed to delivering exceptional customer service. Whether you’re seeking mortgage assistance, home equity support, or general banking advice, our team is here to help. Contact us today, and let’s work together to find the answers you need. After all, your satisfaction is our top priority.

Additional Banking Services and Fees

For more details on our banking services and associated fees, be sure to review the Additional Banking Services & Fees (PDF). One example is the Chase Premier Plus Checking account, which waives the monthly service fee if you maintain an average beginning day balance of $15,000 or more across eligible accounts. It’s just one of the many perks available to our valued customers.